ESPN Outside The Lines Reports On PGA Tour As A "Charity"

/Under the strange headline, "Tax breaks power PGA Tour giving," ESPN's Outside The Lines and reporter Paula Lavigne exam the PGA Tour's charitable giving. They find that as far as "responsible" charities go, the tour is not really a charity.

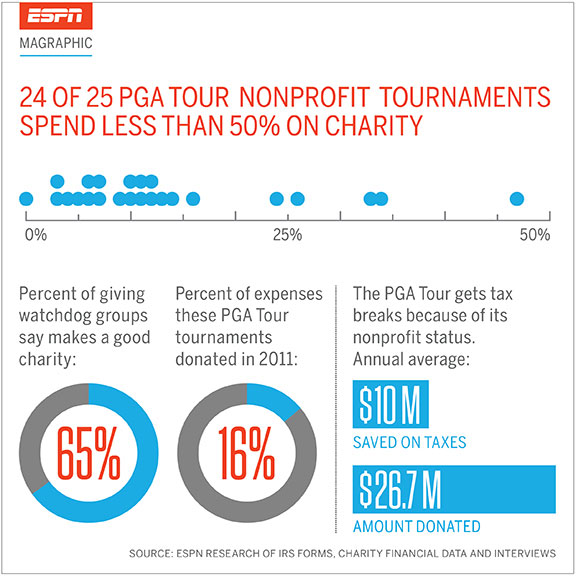

Charity Navigator, the watchdog group which sets it standard to determine what a responsible charity is, says at least 65 percent of money raised should be spent on charity. The PGA Tour average was about 16 percent.

The PGA Tour average was about 16 percent.

Only one PGA Tour event, ESPN found, exceeded that standard: the AT&T Pebble Beach National Pro-Am run by the Monterey Peninsula Foundation, which came in at an impressive 79 percent. ESPN also notes that the Shriners Hospital lost more than $4.5 million over two years. All numbers are from 2011 and yeras prior.

The tour, not surprisingly, was uncooperative and refused to go on camera which in time may be viewed as a collosal mistake because (A) most television viewers believe that refusing to go on camera is an admission of wrong-doing, and (B) Tim Finchem, say what you will, can handle himself just fine talking about these things.

So instead, the PGA Tour responded in emails and phone interviews and I'm not sure the bake sale line will be treasured in charity circles:

"It's as if no good deed goes left unpunished," he said. Votaw declined an in-person interview but answered some questions via email and on the phone.

Tour officials don't dispute that the percentage donated to charity is low, but they say it simply shouldn't matter. What's more important is the bottom line, Votaw said.

"This isn't a bake sale where there is no overhead and everything is contributed," he wrote in email. "A tournament is a major undertaking that requires significant planning, setup and operation, all of which requires significant expense beyond the time contributed by volunteers."

Frankly, I found parts of the story to be eye-opening and others not so compelling, perhaps because we've examined PGA Tour numbers here in the past. That the PGA Tour has not paid $200 million or so in taxes over the last 10 to 20 years, especially in light of other financial crimes committed in that time frame and compared to a PGA Tour event's impact on a community, seems somewhat minor.

However, when ESPN got into the details of the charity spending, the story has more impact. Take this on Youth Programs, Inc in Memphis, beneficiary of the FedEx St. Jude Classic.

On its publicly available IRS form, the purpose of Youth Programs Inc. is to "host an annual professional PGA Tour sports event for the benefit of charitable organizations." In 2011, it made $15.3 million, about 89 percent of that from the golf tournament. It spent $15.3 million, which included about $6 million in prize money for the golfers and $5 million in TV promotion. It spent close to $1 million on tournament production and $500,000 on food and beverages, most likely at a discount, because Youth Programs is also exempt from paying sales tax in Tennessee.

The amount actually spent on charity -- the money given to St. Jude's -- was $1.5 million, or 10 percent of tournament expenses. Only $253,742 of that was actual cash to the research hospital. The rest went to St. Jude ads aired during the televised tournament, pro-am entry fees and air travel for celebrities.

If they spent that much on ads, just imagine how much of the First Tee money raised has been spent on that program's excessive "messaging."

Perhaps a follow-up story will come on a topic that was largely glossed over, but examples of executive overcompensation were few and far between, especially compared to other charities.

The IRS records of other tournaments' finances raise other red flags, including some higher-than-standard salaries, contractors tied to board members or directors, and questionable expenses, such as the Waste Management Phoenix Open paying almost $650,000 to Waste Management of Arizona for trash removal.

"I think it's really awful. I think that it's deceiving the public, and that it's a house of cards that eventually will fall," Charity Navigator's Berger said.

Wow. House Of Cards. Way harsh. BTW, the House of Cards season 2 trailer is live!

Wow. House Of Cards. Way harsh. BTW, the House of Cards season 2 trailer is live!

Sorry, go on...

Although Berger argues that the tournaments can and should donate more if they operated as regular businesses, Votaw said that losing the tax-exempt status would have a "chilling effect on the PGA Tour's ability to continue to contribute millions of dollars to charity."

"The objective of a for-profit corporation is to enrich its owners," he said. "We prefer to enrich communities. The tax laws also do not incentivize for-profit corporations to make significant gifts to charity."

And this is a key point for the tour to keep hammering home in rebuttal: the economic impact of tournaments on communities can be profound (just picture a tour wife going shopping).

But you thought the USGA's cash-hording was scary and evidence of corporate thinking running a non-profit? Check out this bankroll:

Many people take the "nonprofit" designation an organization has as meaning it cannot keep any money it makes above expenses. But that's not true. The PGA for years has carried over profits -- to the tune of $700 million as of 2011. A feature on Finchem this year in Forbes magazine cites the tour's savings as giving the tour a "competitive advantage" that preserved its TV contracts even as corporate sponsors wavered in a shaky economy.

That $700 million is likely what the tour would have paid taxes on were it not structured as a nonprofit, said Brad Borden, a tax law professor at Brooklyn Law School in New York, who reviewed the tour's finances for "Outside the Lines."

"It seems very unfair ... at a time when [the government is] cutting services, they are also providing a subsidy to professional athletes who are playing a game. And this is very troubling."

The story also goes into Senator Tom Coburn's PRO Sports Act to take away the tour's non-profit status, which has been resisted in part by $500,000 in PGA Tour lobbying in 2011. (The NFL spent $60,000 on lobbying at the same time...something tells me they've been spending more lately!)

Votaw says it's not fair to combine Coburn's attempt to take away the tour's nonprofit status with an examination of its individual tournaments -- which would not lose their tax-exempt status under the provisions in Coburn's bill.

"We believe that Sen. Coburn's bill would have a chilling effect on the amount of money raised for charity while generating very little in additional tax revenues," Votaw said. "Sen. Coburn has spent a lifetime trying to reduce the size and scope of government and believes in a strong private sector. If charity is chilled as a result of his proposed bill -- and we believe it will be -- the local organizations that benefit from the PGA Tour will likely turn to government for help.

"In many respects, the tour is the embodiment of what Sen. Coburn believes in. The cost of the exemption is negligible, but the private sector support for charity that is generated is extraordinary and unprecedented in professional sports."

Here is the video version of the Outside The Lines story by Lavigne and producer Arty Berko.